Residential real estate demand outpacing supply

Melinda Waldrop //July 24, 2018//

Diane Bunnell has never seen anything like it.

The housing demand engulfing the nation and mirrored in Midlands markets, coupled with a lack of inventory, has created uncharted territory in Bunnell’s residential real estate field.

“There is a demand for housing that can’t be met, and that’s coming from a couple of different directions,” said Bunnell, broker-in-charge at ERA Wilder Realty’s midtown office on Devine Street. “Builders can’t keep up with the demand. They’re getting squeezed because their costs have gone up so much (that) it’s very difficult for them to build and keep (homes) at a lower price range that a first-time homebuyer is looking for. On the other end of it, you’ve got the generation that might be ready to downsize, and they don’t have anything to go to. They stay in their homes and either remodel them or say ‘We’re just going to sit this out,’ so there’s not as much inventory on the resale market, either.

“It’s really getting squeezed from both ends. We’ve got a lot of pent-up demand, and the inventory just isn’t there. We’ve never quite seen that before.”

In an April article on real estate blog network Curbed, Danielle Hale, chief economist for Realtor.com, called the situation “the most competitive housing market we’ve seen in recorded history. … There are a lot of buyers, and not a lot of sellers.”

Realtor.com data showed that, as of April, inventory had decreased for 42 consecutive months and was down 8.5% from 2017. That makes Bunnell’s job, and that of agents in her office, challenging.

“If you’re the listing agent, then you’re dealing with multiple offers a lot of times, and generally you’re dealing with a shorter time to sell your active inventory,” said ERA real estate agent Petie Bradley. “If you’re a buyer’s agent, you’re scrambling to get your buyer into that house before it goes under contract. You have to be very proactive.

“The good thing is now, because of the internet and the evolution of search engines like Zillow and Realtor.com, people are getting updated on their phones when something comes available. It’s made our jobs easier as real estate agents in that sense, but we have to be very proactive — which we should be anyway.”

Agents also have to make sure their clients understand the realities of the ultra-competitive market, Bunnell said.

“Part of our job is setting that expectation that when they find something they like, they need to be ready to move on it,” said Bunnell, who has seen hesitation cost buyers bids on multiple houses. “If it’s 80 to 85% of what you want, you better move on it, because it’s not going to be there long.”

STEADY RECOVERY

As rising costs have depressed new construction numbers, mortgage loan programs have made homebuying easier and more accessible. While the process is stringent — nothing like the free-for-all that precipitated a burst housing bubble between 2007 and 2010 — qualified homebuyers can put down single-digit percentages of a home’s cost, and first-time homebuyer programs proliferate in the mortgage landscape.

Further fueling the home buying frenzy are interest rates that remain at near-historic lows, hovering in the low- to high-4% range, and a similarly squeezed rental market that often makes home buying a cheaper choice with more options available.

A surge of millennials — expected to represent 65% of first-time homebuyers in 2019, according to the S.C. Association of Realtors — and retiring baby boomers looking to downsize are also driving demand.

“We’ve been recovering very nicely in a robust and steady way since the end of the recession,” said Nick Kremydas, CEO of the S.C. Association of Realtors. “Some markets are heating up to the point of being worrisome.”

“We’ve been recovering very nicely in a robust and steady way since the end of the recession,” said Nick Kremydas, CEO of the S.C. Association of Realtors. “Some markets are heating up to the point of being worrisome.”

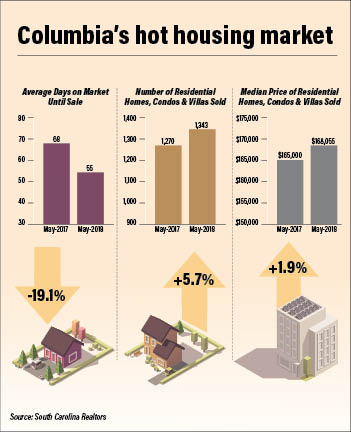

While the greater Columbia market may not be in that territory yet, the 1,343 residential homes, condos and villas sold in May 2018 represent a 5.7% increase from May 2017. The 2,774 homes sold in the first quarter of 2018 represent a 3.4% increase from the first quarter of 2017, while the 5,290 homes sold through May 2018 represent a plus-5.3% change year-to-date.

The median price of area homes has also increased (plus-4.4% year-to-date) while average days on market has decreased (minus-16.9% year-to-date).

Those numbers are magnified in some of the Midlands’ hottest markets, several of which are located downtown. In the Shandon neighborhood, houses sold by ERA Realty averaged 47 days on market in 2017 — down from 106 in 2014 — and are averaging 50 year-to-date. The average sold price increased from $278,484 in 2014 to $324,242 in 2017 and stood at $340,333 through June 30.

Houses in Rosewood are spending an average of 44 days on the market year-to-date, down from 53 in 2017 and 89 in 2014, and currently selling for an average of $147,721, approximately $4,000 more than last year and substantially more than 2014’s average of $116,295.

Those trends are also seen in the Earlewood and Elmwood Park neighborhoods, while neighborhoods in Northeast Columbia and Lexington remain popular.

“The good houses in a good neighborhood that are priced well are going to sell quickly,” Bunnell said. “The inventory is lower in some places, and that’s just a function of total homes that are available. Shandon has no place to grow. Rosewood has no place to grow. Northeast and Lexington do.”

Bradley said new construction is also moving toward more rural areas in Swansea and Gaston.

WHAT WILL $150,000 BUY?

As to what homebuyers can expect to pay, that varies from area to area.

A sampling of Bradley’s listings in the $150,000 range include:

- A two-bedroom, two-bath, 1,176-square-foot listing for $142,000 in Rosewood

- A two-bedroom, one-bath, 1,058-square-foot listing for $149,000 in Earlewood

- A three-bedroom, two-bath, 1,653-square-foot listing for $150,000 in Northeast Columbia

- A three-bedroom, two-bath, 1,521-square-foot listing for $150,000 in Forest Acres

- A four-bedroom, two-bath, 1,768-square-foot listing for $150,000 in West Columbia

- A three-bedroom, two-bath, 1,904-square-foot listing for $152,900 in Lexington

Kremydas called $150,000 “the magic number right now for starter homes in many markets,” but added, “In growing areas, that first-time homebuyer is really feeling the squeeze. There are some communities where you can buy a really fantastic house for $150,000. There are some communities where you can’t find a zero-bedroom efficiency for twice that.”

The median housing price has topped $300,000 in one S.C. market, climbing to $315,000 year-to-date (a 6% increase) in the Hilton Head area. In the Charleston Trident market, the median price has increased 6.5% year-to-date to $264,000.

Even at such prices, in such a competitive market, homebuyers are still discerning, Bradley said.

“People want energy efficiency,” she said. “They want to leave less of a footprint. They’re more environmentally conscious. They do like things to look good. Most buyers still do not want to go in and do rehab projects. They want it move-in ready.”

With technology such as online site listings making home shopping even easier, more millennials reaching homebuying age and 10,000 baby boomers turning 65 every day, demand for housing seems likely to keep growing.

“The real estate gurus through the country really don’t see this inventory situation letting up anytime soon,” Bunnell said. “… Studies are showing that there’s still, in this country, a very, very high value on home ownership.

“For the vast majority of people, it’s their dream.”